All IPE articles in March 2019 (Magazine) – Page 2

-

Features

FeaturesMacro matters: Brexit’s challenge for Europe

It is human nature to reduce the complexity of reality to simple rules, simple foci and simple decision points. In this, Brexit is no different

-

Features

FeaturesESG: Bridging the impact data gap

A new framework aims to allow asset managers to quantify investment impacts

-

Special Report

Chris Sier: Data brings freedom

A UK fintech envoy talks about the potential for technology to empower investors

-

Features

Buyouts: Philip Green’s M&S venture

Philip Green, a British retail billionaire, is perhaps best-known for the controversy surrounding the pensions deficit of his defunct BHS high street chain

-

Country Report

Country ReportLGPS pooling: Funds under pressure to comply

About 30% of assets have been absorbed by the new LGPS pools

-

Special Report

Special ReportStrategy: Pension funds confront FX risk

Investors are paying more attention to currency hedging strategies in the face of increased global risk

-

Asset Class Reports

Asset Class ReportsRatings: When corporates can trump sovereigns

Several factors can place corporate credit ratings higher than that of the domicile country

-

Special Report

UK Financial Reporting Council: On the radar

Reactions to the Kingman review on UK corporate reporting oversight

-

Features

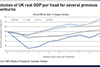

FeaturesThe euro crisis is not over

The euro’s existential crisis subsided several years ago but it would be wrong to assume it has disappeared. The forces that could undermine its integrity have not vanished.

-

Features

FeaturesFixed income, rates, currencies: Global economic discomfort

Fed’s wait-and-see approach to monetary policy adds to contradictary signals

-

Special Report

Special ReportData and processes: The IT diet

Sophisticated data and analytics processes should drive better control in investment functions

-

Opinion Pieces

Opinion PiecesGuest viewpoint: David Kavanagh

The deadline for national implementation of the IORP II directive passed this January

-

Features

FeaturesLessons from Down Under

As Australia is one of the world’s largest DC markets, the recent government-backed inquiry into financial services deserves a closer look

-

Asset Class Reports

Asset Class ReportsIssuance: Down but not out

The huge growth of BBB-rated credits in the investment-grade sector has raised some concern but there are opportunities for investors

-

Special Report

Special ReportPension tech for dummies

There is no shortage of new technologies that can improve retirement outcomes for pension fund members

-

Country Report

Funding: Where do pension funds end?

Identifying the funding horizon means balancing objectives and expectations, particularly given likely prescriptive new funding rules

-

Country Report

Country ReportFiduciary managers: A healthier market?

Standardisation of data provision could prove essential to driving greater competition in UK fiduciary management

-

Opinion Pieces

Opinion PiecesFirebrand targets supervision

One of the knottier issues in Brussels at the moment is the future of the European supervisory authorities

-

Features

FeaturesNordic focus: A northern pensions hub

Innovation showcase: three Danish pension tech case studies

-

Opinion Pieces

Hedge funds under scrutiny

Last year was good for hedge funds in terms of raising new money. But at the same time the industry suffered its biggest annual loss since 2011

- Previous Page

- Page1

- Page2

- Page3

- Next Page