All IPE articles in October 2019 (Magazine)

View all stories from this issue.

-

-

-

Features

IPE Quest Expectations Indicator: October 2019

There has been a widening of the equity sentiment gap between the euro-zone and the US, and the UK and Japan.

-

Features

The accounting backstop

What if the Irish government pumped €64bn into its banking system to repay loans to the European Central Bank (ECB) and the Irish Central bank illegally?

-

Features

FeaturesAhead of the curve: New economy, same old returns?

“You can see the computer age everywhere but in the productivity statistics.”

-

Opinion Pieces

Long-term matters: How capitalists can save the Amazon from capitalism

When foundations and wealthy individuals launched their Rapid Response-Able Fund (RRAF) in spring 2020, commentators sneered at the “save the world” motivation while others said it would distract attention from the political changes that were needed.

-

Features

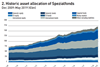

FeaturesGerman Spezialfonds show modest asset growth

Germany’s Spezialfonds market showed modest positive growth in 2018 in the face of challenging market conditions, with total assets approaching €1.5trn.

-

Interviews

InterviewsStrategically speaking: Wells Fargo Asset Management

By his own account Nico Marais is an extraordinarily lucky man. The CEO of Wells Fargo Asset Management (WFAM) is keen to use every opportunity to emphasise his good fortune. In Marais’s modest telling of his own story, his success is thanks to the qualities of others, rather than to his own merits. “It’s the story of my life. I’ve just always worked for amazing people,” he says.

-

Asset Class Reports

Asset Class ReportsESG awareness grows

Smaller companies are realising they must keep up with ESG and impact-investing standards to remain successful

-

-

Opinion Pieces

Opinion PiecesDo not let costs become an obsession

Our report this month on management and outsourcing discusses how pension funds must increasingly rely on external organisations to analyse their portfolios, particularly from a cost perspective.

-

Opinion Pieces

Opinion PiecesLetter from The US: How boards can hurt pension plans

US state and local pension funds manage over $4trn (€3.6trn) in retirement assets for 20m active and retired plan members. But most of the funds are in bad financial shape.

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Jennifer Choi & Brian Hoehn

“Principles 3.0 is intended to offer a road map to optimal partnerships in the private equity industry”

-

Features

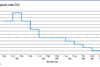

FeaturesBriefing: Draghi’s parting gift on ECB stance

If anyone in Europe was left in any doubt on 11 September about the dovishness of the European Central Bank (ECB) under Mario Draghi’s leadership, by close of business on the next day their doubts were surely dispelled. On that day the outgoing president of the ECB unleashed a bout of monetary easing, in an attempt to boost euro-zone inflation from 1% to its target of “below, but close to, 2% over the medium term”.

-

Features

FeaturesBriefing: US makes rapid turnaround

Father Christmas delivered a sack of coal to equity markets last Christmas Eve, with the S&P 500 index losing 1.8%, following a three-day slide. Forecasters had previously been expecting two or three rate hikes in December, as Federal Reserve chairman Jerome Powell steered that discussion. He had mistakenly assumed that the economy had not yet reached a normal, neutral level but it already had, forcing him to backtrack.

-

Features

FeaturesBriefing: Deep tensions threaten EU vision

This is not a commentary on the UK within or without Europe. Brexit has been a compelling distraction but it is one macroeconomic strand in a complex world. The overwhelming coverage has also moved attention away from key internal tensions within the European project.

-

Features

FeaturesBriefing: Coping with lower for much longer

German institutional investors have shifted their asset allocation due to low bond yields

-

Country Report

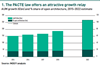

Country ReportFrance: PACTE changes the landscape

The new PACTE law will transform pension saving in France

-

Opinion Pieces

Opinion PiecesPensions in a hostile climate

Outside the realm of US public pension plans, where generous return assumptions and inflated discount rates are common, the medium and long-term outlook for asset classes is of serious importance to most pension funds.

-

Asset Class Reports

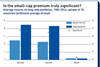

Asset Class ReportsThe small-cap conundrum

Academic studies have cast doubt on the existence of a premium for investing in small-cap stocks