Eight public sector pension funds in Wales have appointed Russell Investments and Link Asset Services to help pool and run £15bn (€17bn) of investments.

The Wales Pension Partnership (WPP) – one of eight asset pools being set up by UK local government pension schemes (LGPS) – announced today that Link Asset Services would operate a collective investment vehicle to pool its assets.

Russell has been appointed for investment advice and manager selection. The mandates for Russell and Link include portfolio construction, cost reduction, currency hedging, transition management and other services.

Chris Moore, director of corporate services at Carmarthenshire County Council, described the appointments as “a significant milestone” in pooling the Welsh funds’ assets.

Peter Hugh Smith, managing director of Link Fund Solutions, part of Link Asset Services, said: “We are pleased to have been selected by WPP to facilitate the pooling of the assets of the eight existing local government pension schemes in Wales.

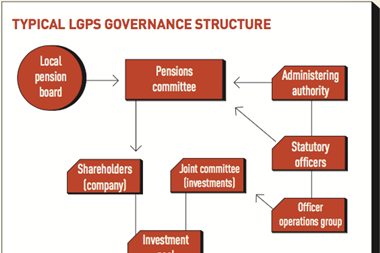

“The pooling of the assets into a collective investment vehicle means the constituent authorities will benefit from enhanced governance and the protection of a regulated tax transparent structure.”

Jim Leggate, head of UK institutional and Middle East at Russell Investments, added that pooling “provides the opportunity to deliver significant savings over the long-term, which will create additional value for scheme members”.

In 2016, WPP appointed BlackRock to run nearly £3bn of passive mandates on behalf of the eight pension funds, replacing State Street Global Advisors and Legal & General Investment Management. This arrangement will continue outside of the collective investment vehicle being established by Link.

The LGPS pools must be ready to accept assets from early April, according to the government’s deadline.

Link is one of the UK’s leading fund administration providers, and according to its website oversees roughly £45bn of annual payments across various product types.