All IPE articles in September 2017 (Magazine)

View all stories from this issue.

-

Special Report

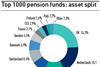

Special ReportTop 1000: A bird’s eye view of €7trn

The assets captured in IPE’s annual study of the leading European retirement asset pools total €7.04trn, up from €6.74 last year – an increase of 4.45%. Yet this growth in assets masks a varied picture

-

Features

FeaturesIPE Expectations Indicator September 2017

Investment managers’ expectations have been welcomingly accurate throughout the year. For example, positive sentiment toward European equities began to rise sharply near the end of 2016, followed by a roughly 20% rise in 2017. Additionally, expectations for dollar strength have been falling since January, and the dollar index (DXY) was down nearly 10% year-to-date through the recent survey period. What are managers’ views as we enter the second half of 2017?

-

Features

Syntrus Achmea saga concludes

Wonen, the €3.2bn pension fund for the Dutch furnishing sector, confirmed plans to transfer its pensions administration from Syntrus Achmea Pensioenbeheer to TKP Pensioen

-

Country Report

Outsourcing: Funds over Achmea debacle

Industry-wide pension schemes have worked quickly to find new administrators to replace Syntrus Achmea

-

Country Report

Country ReportAuto-enrolment: Auto-enrolment still faces acid test

Millions of workers have joined workplace pension schemes under auto-enrolment but there is still some way to go before full adoption

-

Country Report

Transfer values: Advice, please

Cash equivalent pension transfers offer members flexibility and lower the funding burden for employers. What’s not to like?

-

Features

Investment advisers need more scrutiny

The quality of investment advice to pension funds needs to improve

-

Features

Trade dispute: Germany against the rest

Foreign criticism of Germany’s strong trade performance is escalating

-

Features

Towards a higher retirement age

Europe needs to continue pushing through tough measures such as the recent increases in retirement ages seen in several countries

-

Features

Ahead of the Curve: Oil as an economic barometer

As Donald Trump’s presidency faces its sternest political tests so far, markets have begun to temper some of their frothiness

-

Country Report

Country ReportDutch pensions: Aiming for full transparency on costs

Dutch funds are now required to provide deeper insight into their expenses in their annual reports

-

Country Report

Asset Allocation: In the mix

Asset allocation review for the largest Dutch pension funds

-

Features

Asset Allocation: A Goldilocks period for risk

With such a notable lack of inflation throughout developed markets, the world’s seemingly synchronised economic growth spurt is not really reflationary in the classic sense

-

Asset Class Reports

Latin America debt: A complex opportunity

Latin American debt is no longer just a tactical trade

-

Country Report

Covenants: Inadequacies in the covenant assessment process

How should UK pension fund trustees evaluate the credit risk they are exposed to in their main employer sponsor?

-

Features

FeaturesInterview: Christian Hyldahl, ATP

Less than a year into the job, ATP’s new chief executive is already stamping his own set of priorities on the giant Danish pension fund

-

Special Report

Austria: Politics distracts from pensions

Pension reforms take second place to political squabbling

-

Special Report

Investment Solutions: No turning back

The way UK pension schemes receive investment advice could change following an investigation by the financial regulator

-

Special Report

Belgium: Cross-pillar reform target

The government has been acting on reform recommendations from the Pension Reform Commission