The €57.4bn Finnish pension fund Varma found in a new survey that 97% of its external investment managers have principles for responsible investment aligned either fully or partially with its own principles.

Some 87% of respondents in the poll – which Varma said was the most extensive one it had yet conducted among fund management companies – were shown to have an organisation-wide ESG policy, while 85% had committed to the UN Principles for Responsible Investment, according to a statement from the earnings-related pension provider.

Hanna Kaskela, senior vice president, sustainability and communications at Varma, said: “As a major investor, we must also be able to disclose information about the responsibility of investments that we do not manage ourselves.

“With this survey, we wish to increase transparency in our fund investments,” she said.

The poll was also a tool for the Helsinki-based mutual pension insurance company to implement its responsibility goals, Kaskela said, as it allowed the firm to monitor whether responsibility was being developed in the fund management companies in a way that matched the accounts they have given Varma.

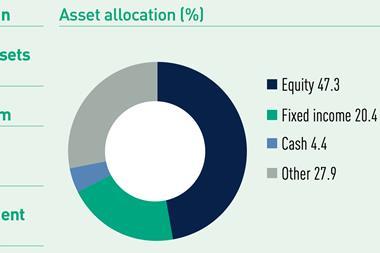

The asset managers polled by Varma together run €31.9bn of investments – 56.8% of the pension provider’s entire portfolio.

Other findings were that 50% of respondents had linked remuneration to ESG outcomes, and that 75% had a human rights policy.

Fund managers excluding certain investments from their holdings constituted 54% of respondents, with those blacklists usually concerning weapons, tobacco, adult entertainment, lignite and coal production, fossil energy and human rights violations.

Some 22% of respondents had set science-based emission reduction targets, Varma said.

Kaskela said the finding that nearly all Varma’s external managers were partially or fully aligned with its own principles was how it should be – because a fund manager’s responsibility was assessed whenever an investment decision was made.

She clarified that “partially” aligned meant some managers may have exclusions and climate targets which did not align completely with Varma’s policies.

“We will most likely never reach a full hundred per cent because the principles for responsible investment evolve with the times and fund management companies react to changes at their own pace,” she said.

Varma said the responses in the survey differed somewhat according to sector and fund type, and that while some respondents had come quite a long way in their responsibility efforts, some had more work left to do.

The firm said it intended to repeat the poll regularly, saying: “This will also show in which direction the fund management companies develop their operations and whether responsible investment brings the desired results.”

Read the digital edition of IPE’s latest magazine