All IPE articles in July/August 2022 (Magazine)

View all stories from this issue.

-

Country Report

Country ReportCountry Report – Pensions in Italy (July/August 2022)

Italy’s pension industry continues to develop, albeit at a slow pace. Italian pension funds are adapting their strategies to the volatile and uncertain market regime, by purchasing inflation-linked assets and by taking advantage of potentially higher yields on domestic government bonds. However, as our lead article highlights, they are generally staying true to their long-term diversification strategies, which consist of gradually allocating to alternatives including private equity, private debt and infrastructure. Some have bought shares in the Bank of Italy, a private equity-like investment.

-

Features

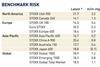

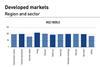

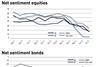

FeaturesQontigo Riskwatch - July/August 2022

* Data as of 31 May 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

-

Features

FeaturesIPE-Quest Expectations Indicator commentary August 2022

The war in Ukraine has reached stalemate. Neither party is capable of a surprise win, but time works against Russia. Can Zelensky keep the army motivated to continue? A long, hot European summer

-

Opinion Pieces

Opinion PiecesLet’s not get carried away about ESG ratings

Elon Musk’s reaction to Tesla dropping out of the S&P ESG 500 index and the publication of a high-profile paper on the ‘Aggregate Confusion’ of ESG ratings have helped trigger a renewed discussion about ESG ratings. At a time when the European Commission and UK rule-makers weigh potential regulatory action, it is important to be clear about what the problem is that needs to be solved and for whom.

-

Interviews

InterviewsOn the record: Are asset managers serious about sustainability?

After a series of cases of alleged greenwashing by asset managers, institutional investors comment on whether the industry is truly committed to sustainable investing

-

Country Report

Country ReportItaly: Pension funds adapt to a new regime

Inflation, higher interest rates and geopolitical tensions are leading Italian pension funds to recalibrate their investment strategies

-

Features

FeaturesAhead of the curve: solving the Russian share ban

Index investors inherently choose to follow the market through exchange-traded and index funds, but the recent prohibition on trading Russian stocks and their removal from global benchmarks has created something of a conundrum.

-

Opinion Pieces

Opinion PiecesNorway needs another pensions overhaul

It’s official – Norway’s state pension system needs another overhaul. The Pension Commission published its hefty report in June arguing for changes to make it socially sustainable – raising age limits, pegging minimum benefits to wage growth and shielding disability pensions from the effects of life expectancy adjustment.

-

Opinion Pieces

Opinion PiecesUS: A cautious approach on private assets in DC plans

Will 2022 be the year when private equity is finally incorporated in US defined contribution (DC) plan line-ups? Possibly, following the Department of Labor’s (DoL’s) clarification of its position in a letter last December. But it will be a very slow process, according to industry experts.

-

Features

FeaturesAsset owners need to find the best stock pickers

For pension funds, an asset manager search is a high-stakes exercise. Get it wrong and the scheme could be saddled with an underperforming manager for an extended period of time, dragging down returns and potentially impacting member outcomes.

-

Features

FeaturesCustodians will be key as investors move into digital assets

Digital assets may seem to be the latest investment trend, but institutions are taking their time in embracing them. Moving interest to the next level will require not only greater regulation but also a solid network of custodians to provide the required security and protection.

-

Opinion Pieces

Opinion PiecesAustralia: Superannuation funds on a consolidation path

Australians are beginning to get used to super funds with names like Australian Retirement Trust, Aware Super and Spirit Super.

-

Features

Features‘Painful’ private equity fees are hard to avoid

The Netherlands’ €551bn ($576bn) civil service scheme ABP paid a record €2.8bn in performance fees to private equity managers in 2021, prompting the fund’s president Harmen van Wijnen to announce an external investigation to assess ABP’s rising asset management costs. The €277.5bn healthcare scheme PFZW paid €1.26bn in performance fees to private equity last year, accounting for two thirds of total asset management costs.

-

Features

FeaturesFixed income, rates & currency: inflation battle in full swing

As we reach the midpoint of the year, there is little sign that the second half of 2022 will be any less turbulent than the first. The conflict in Ukraine slogs on – a destructive war of attrition, pain and fear. The repercussions are huge, global and unpredictable, be they surging energy prices or impending, but acute, shortages of basic foodstuffs, or of semi-conductors, so vital to 21st century life.

-

Interviews

InterviewsExit interview: Christian Boehm

Christian Boehm, who stepped down as CEO of the Austrian Pensionskasse APK at the end of June, wasn’t expecting to retire in a year of seismic changes. He has spent his final months as CEO not only witnessing at first hand how the investment approaches of pension funds are rapidly changing, but also observing the wider effects of the war in Ukraine.

-

Asset Class Reports

Asset Class ReportsCredit: Inflation and the bond markets

Risks look likely to be building in credit as central banks wreak collateral damage on economies in their bid to tame inflation

-

Opinion Pieces

Opinion PiecesHow to bridge a most obvious pension investment gap?

Investment luminaries were recently invited by the CFA Institute to give their opinion on the financial system in a publication to mark the quarter century of the institute’s research award to commemorate Jim Vertin.

-

Features

FeaturesA broader view on corporate pension disclosures

What is not to like? Finally, a principles-based approach to the disclosures in financial statements that aims to cut the clutter and home in on the material that is truly material.