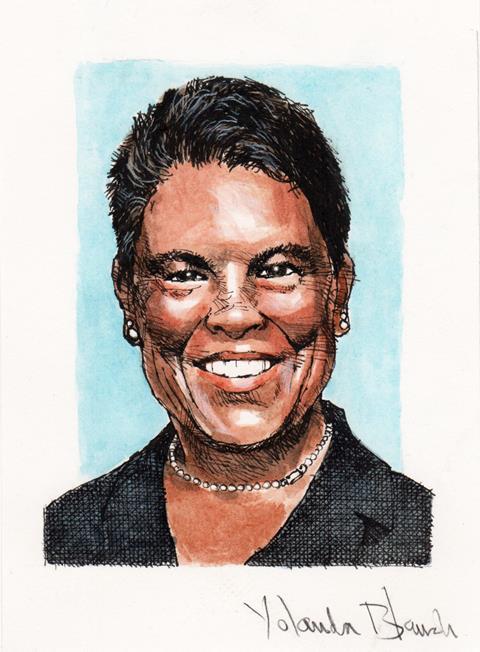

As chair of Pensions Caixa 30, Yolanda Blanch is committed to forging ahead with what she describes as “systematic leadership”

When Yolanda Blanch took the chair of Pensions Caixa 30 (PC30) in 2023, she brought an unusual combination to pension fund governance: two decades as an FX options trader, a deep commitment to collaborative leadership and a philosophical framework that views uncertainty not as a problem to be solved but as an inherent quality of reality.

Managing the retirement security of 70,000 CaixaBank participants – employees and ex-employees with very diverse political views, risk tolerances and life circumstances, across a fund with €7.5bn in assets, which rises to €8.5bn when including risk coverage for death and disability – requires more than traditional fiduciary expertise. It demands what Blanch calls “systems leadership”.

This approach recognises the pension fund as part of an interconnected global system shaped by demographic shifts, geopolitical instability, and environmental constraints. As she frames it, “uncertainty is an ontological quality of reality”, which means the focus must be on building robust decision-making processes rather than seeking certainty where none exists.

Blanch’s journey from derivatives trader to pension chair has equipped her with technical financial expertise combined with hard-won insights about leadership styles that work and those that don’t. She speaks candidly about experiencing both kinds: leadership grounded in kindness and active listening versus environments marked by more aggressive styles.

This personal history informs her three pillars of leadership: lived experience in organisations; a commitment to kindness and compassion; and psychological insights drawn from behavioural economics and cognitive science.

“I used to think that leadership was about knowing everything all the time – having all the questions and all the answers,” she reflects. “Now I have completely changed my mind. Leadership is about creating the right conditions so everyone can bring in their full knowledge, experience and intuition.”

This collaborative approach isn’t merely aspirational rhetoric. For several years, PC30’s Board of Trustees has worked with the Thinking Ahead Institute (TAI), a UK-based global think-tank, to build what Blanch describes as a “collaborative culture” specifically focused on making the decision-making process as solid as possible.

The partnership has yielded practical frameworks. The board developed a “meeting manifesto” that has provided an opportunity where all ideas are heard, and members can engage in both dialogue – listening and suspending their own views and discussion – and actively challenge ideas. The board has integrated TAI’s research on “superteams” to improve how its 15 members, representing both unions and the employer, work together.

For Blanch, listening to people stands as the “first ingredient” for high-performing boards. She points to Google’s Project Aristotle, which concluded that teams perform best when members feel safe to be vulnerable and take risks without fear of judgment. This isn’t about avoiding disagreement but creating conditions where intellectual humility can flourish – where participants continuously challenge their mental models about reality.

Distinctive governance structure

PC30 operates within a distinctive governance structure that Blanch views as a competitive advantage rather than a constraint. The fund’s day-to-day investment management and benefit payments are handled by VidaCaixa, part of the CaixaBank Group and one of Spain’s leading insurance companies. This 25-year relationship, arising from the common ownership structure, has precluded the use of external asset managers.

“Some people think that it is a constraint, but I see it as a strength,” Blanch explains, as there is an alignment of goals and mutual trust. “We are cautious in our approach, but we do so alongside a top-tier player, which provides us with strength and confidence throughout the process.”

The arrangement allows the board of trustees to focus on strategic asset allocation while VidaCaixa retains freedom for tactical adjustments, such as modifying the net dollar exposure from the 55% benchmark to capture short-term market opportunities. As a defined contribution plan, PC30 operates without the liability-driven investment complexities that characterise defined benefit schemes but maintains rigorous risk controls aligned with CaixaBank Group standards.

PC30’s investment philosophy reflects its governance approach: deliberate, research-driven and cautious about dramatic shifts. As Blanch argues, the fund is “like a big ocean liner” whose direction must be clear, but where constant course changes are neither necessary nor desirable. Small adjustments occur annually, but major strategic pivots are rare. However, changes are monitored continuously and, if such shifts were ever necessary, they would be implemented.

The current asset allocation reflects this steady-state philosophy: roughly 50% in fixed income and cash provides a conservative anchor; 30% in listed equities captures growth opportunities; and 20% in illiquid assets including private equity and real estate offers diversification and potentially enhanced returns.

Home bias is not an issue for the fund: “To manage the risk-return profile over the long term, we believe it is preferable to maintain diversification across asset classes and geographic regions,” Blanch explains. “So local investment – which for us means Europe, not Spain – is not a priority.”

However, within this framework of geographic diversification, the fund closely monitors illiquid opportunities emerging from Europe, particularly given recent market concentration in global benchmarks that has skewed exposure toward US equities. Concern about this has led to the board fine-tuning the portfolio by moving 5% of climate global equity exposure into European climate-related equities.

Alternative assets receive careful scrutiny at PC30. The fund’s approach to private markets reflects measured assessment of a sector that has matured significantly. “It is now a mature market, with demanding valuations,” Blanch notes, although the fund maintains an exposure.

By contrast, bitcoin and cryptocurrencies, generally, are viewed as too volatile and speculative for a long-term fiduciary portfolio. Gold raises different considerations with the environmental and social impacts of mining, including high energy use and pollution, making it difficult to align gold holdings with ESG objectives.

What the fund does favour are catastrophe bonds, which offer the advantage of being uncorrelated with economic cycles while serving a social purpose – ensuring that people can protect their homes and property.

For pension funds focused on long-term value creation, Blanch argues that ESG considerations are inseparable from financial returns. However, she adds: “The fiduciary duty of pension funds remains to deliver stable, long-term returns – not to address complex global issues that fall outside their domain.”

Well-intentioned actions, she warns, can produce unexpected consequences, “the road to hell is paved with good intentions”, as she puts it. This is why, Blanch insists, “it’s essential to closely follow both industry developments and scientific research, continuously incorporating new information into investment decisions”.

She advocates “sustainability 2.0” – a holistic view recognising that “we are nature”. This framework considers not just CO2 emissions but pollution, biodiversity and human well-being. The fund monitors principal adverse impacts in line with SFDR regulations and discloses its carbon footprint following the Montreal Carbon Pledge, with reporting aligned to TCFD and UN PRI frameworks.

The fund’s stance on potential defence investments illustrates the complexity of ESG in practice. The issue sits at the intersection of two contrasting perspectives: one emphasising defence as essential for safeguarding democratic societies, even framing it as “D for defence and democracy” within ESG; the other highlighting their lethal nature.

PC30 currently maintains exclusions for controversial weaponry and holds no defence investments, though Blanch acknowledges that “the relative weight of these perspectives often shifts” between times of stability and periods of heightened risk.

Demographic changes

Demographic changes pose significant challenges. Younger generations face greater financial difficulties and need to assume higher risk levels to build adequate savings.

Simultaneously, older generations are living longer, creating a paradox: should extended longevity mean taking more risk due to longer time horizons, or less risk to protect capital during extended dependency years? As additional context, Spain’s pension system is characterised by a comparatively high first‑pillar replacement rate and a small second pillar within the European landscape.

PC30 is analysing a life-cycle approach that would allow automatic risk adjustments according to age while offering alternative options for members who might want to maintain higher risk levels for legacy purposes.

“I have been working 20 years as an FX options trader, so I am used to risk,” Blanch reflects. “But someone may be so afraid of losing 3% that they cannot sleep, so it is not enough to rely solely on objective criteria such as age or investment horizon.”

The life-cycle framework being developed will attempt to accommodate this diversity of risk tolerances, offering conservative bond options alongside higher-risk alternatives for members who don’t need immediate access to capital or wish to preserve wealth for heirs.

Engaging 70,000 members across all age groups presents its own challenge. In 2025, PC30 launched Aporta+, a Vidacaixa platform allowing members to view all savings products in an aggregated way while giving the board direct communication channels with participants.

Gamification initiatives aim to engage younger members through quizzes about the plan, with winners invited to spend a day with the Board and VidaCaixa to see how their retirement savings are managed.

Blanch’s leadership of Pensions Caixa 30 ultimately rests on a simple but profound purpose: “To bring the best pension plan possible to our 70,000 participants.”

The fund’s strategic choices – diversifying across asset classes to capture uncorrelated returns, maintaining geographic diversification without a home bias, exercising a measure approach in mature private markets, rejecting speculative assets such as bitcoin while embracing catastrophe bonds, and carefully weighing ESG considerations within the framework of fiduciary duties – all flow from this central commitment.

As Blanch notes, “we live in a complex world” in which, as she has said, “uncertainty is an ontological quality of reality”. The response isn’t to seek impossible certainty, but to build robust processes that can adapt to whatever emerges.