All articles by David Turner

-

Special Report

Special ReportUK: After the deluge

Investors are still wary about where the UK’s economy might be heading despite the country’s trade deal with the EU

-

Features

FeaturesSelectivity is key in SPAC market

The vogue for special purpose acquisition companies (SPACs) has something in common with many other fashions, whether in investment or in the shops. Just when you think the trend cannot get even hotter, the temperature rises yet further.

-

Features

FeaturesBriefing: Active ways to prosper in EMs

On the battlefield on which active managers fought their passive enemies for investors’ custom, there was one patch of higher ground that seemed easier to defend – emerging market equities.

-

Special Report

Special Report2021 Investment Horizons: Hazy outlook for hedging

Investors must be cautious when navigating today’s cloudy inflation landscape

-

Features

FeaturesBriefing: Which way will inflation blow?

Investors pondering the future course of inflation are scratching their heads – faced as they are with a powerful array of deflationary factors, opposed by a potent lineup of inflationary factors.

-

Features

FeaturesBriefing: Hybrids come into their own

Back in the days when sailors relied on sails, they used to dread the doldrums – that zone near the equator where trade winds converge, generating windless weather.

-

Special Report

Risk-free rates: Forging ahead

UK funds have largely ditched LIBOR but the situation for credit funds is more complex

-

Features

FeaturesChina: On a long climb up the ESG ladder

China is the world’s biggest emitter of greenhouse gases, compels imprisoned Muslims in Xinjiang to toil in factories, and has Communist Party committees embedded in companies, exercising a shadowy influence over management. It is, in other words, not exactly a poster child for good ESG performance.

-

Special Report

US recession: Slow and steady

Undramatic growth has characterised the longest economic expansion in US history. As trade tensions rise can the momentum be sustained?

-

Features

FeaturesBriefing: There is still room for growth

Equity investors putting faith in growth stocks – stocks that are priced expensively relative to fundamentals because they are expected to grow fast – received a shock in early September when they sold off sharply.

-

Features

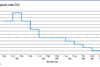

FeaturesBriefing: Draghi’s parting gift on ECB stance

If anyone in Europe was left in any doubt on 11 September about the dovishness of the European Central Bank (ECB) under Mario Draghi’s leadership, by close of business on the next day their doubts were surely dispelled. On that day the outgoing president of the ECB unleashed a bout of monetary easing, in an attempt to boost euro-zone inflation from 1% to its target of “below, but close to, 2% over the medium term”.

-

Special Report

Special ReportEuropean benchmarks: Meet Sonia, €STR and Saron

European interest rate benchmarks reform will bring new challenges for asset managers and investors

-

Special Report

Technology: Disparities impede EU progress

The EU is not achieving its true potential on the global technology stage because it is still not operating as a fully fledged single market

-

Special Report

Special ReportApplying rocket science to EMs

Factor investing strategies are increasingly being used in emerging market investing

-

Special Report

Special ReportSterling scenarios

Sterling will remain mired in uncertainty as long as the conflict over Brexit is unresolved

-

Special Report

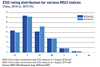

Fixed income: Will it be E, S or G?

The three components of ESG investing in fixed income – environmental, social and governance – cannot be maximised simultaneously. Investors must decide which to emphasise

-

Special Report

Sterling: Two sides of the coin

Many analysts see sterling as undervalued but investors expect a premium to compensate for Brexit uncertainties

-

Features

Financial Crises: Awaiting the Minsky moment

The bout of marked market volatility in February prompted a heated debate: were financial markets close to a Minsky moment?

-

Asset Class Reports

Interest Rates: Opinion divided on rate impact

Market professionals are divided on the likely impact of rate rises on the equity markets