All IPE articles in December 2018 (magazine)

View all stories from this issue.

-

Interviews

InterviewsHow we run our money: Första AP-fonden (AP1)

Mikael Angberg, CIO of Första AP-fonden (AP1), one of Sweden’s buffer funds, outlines the fund’s investment philosophy to Carlo Svaluto Moreolo

-

Special Report

AP2: Demanding but worthwhile

AP2’s in-sourcing journey has reduced costs and boosted its flexibility and transparency

-

Features

FeaturesChecking back on 2018

In January, in this column, I highlighted areas to watch for 2018. In the spirit of holding myself to account, it’s time to see how they panned out

-

Features

FeaturesIPE Expectations Indicator: December 2018

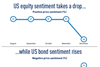

At times we aim to find the mountains within the molehills of manager expectation shifts. In our defence, any curvature is worthy of recognition. Sometimes, changes (or lack thereof) come along that are worth diving into. In the prior survey, it was the four-month lack of change within the high sentiment toward US equity markets to rise that was significant. During the current period, hyperbole aside, change has come.

-

Opinion Pieces

Long Term Matters: What should investors do about authoritarian governments?

In October, I wrote that investors would soon have to choose between backing social justice or going along with authoritarian- ism. I was not expecting that the choice would come so quickly

-

Features

Accounting Matters: The audit F-word

Increased incidence of accounting fraud raises questions about UK audit standards

-

Features

Credit allocations: Time for a re-balancing act

Investors are ignoring indicators that should encourage a more selective approach to credit

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Simon Lewis, AFME

Europe’s capital markets are facing some of their toughest challenges since the global financial crisis

-

Country Report

Illiquid Investments: Challenges ahead

Illiquid investments should appeal to pension funds because of their long-term benefits, but are opportunities equal?

-

Features

Fixed income, rates, currencies: Challenges still lie ahead

While the US mid-term elections saw the Democrats regain the House of Representatives, trade policy remains in the hands of the White House. Trade tensions, between the US and China in particular, will remain to the fore. President Trump’s aggressive trade policy is already having a global impact with declining purchasing manager indices indicating corporate hesitation in future plans.

-

Features

Ahead of the curve: Sporting a safety jacket in a market of weak protections

Funds that take on loans that have been rejected by banks are likely to be problematic for investors

-

Special Report

AQR: Risk-parity reasoning

John Huss and Yao Hua Ooi, principals at AQR, explain the firm’s approach to risk parity

-

Country Report

Country ReportAsset Management: Fit for purpose

The globalisation of asset management means that Swiss managers have to broaden their product range and service different regulatory regimes

-

Special Report

ATP: In-house benefits

ATP values being at the investing coal face as a learning experience

-

Asset Class Reports

Central Banks: Be wary of the bulls

Opposing views on the timing and effects of quantitative tightening suggest investors should be cautious of high valuations

-

Features

FeaturesDutch reform: ‘Complexity and stubbornness killing world’s best pensions system’

Despite ranking as the world’s best in the Melbourne Mercer Global Pension index, the Netherlands’ pensions system is being hit by too much complexity and ineffective regulation

-

Opinion Pieces

Letter from the US: REITS a good long-term bet, says study

Investors have lost some of their enthusiasm for US REITs – real-estate investment trusts – after their poor performance in the third quarter. From July to September, the FTSE Nareit All Equity REITs index gained 0.5%, compared with a 7.6% return for S&P 500 over the same period. The return of the REITs index has trailed behind S&P 500 by more than seven percentage points for the first three quarters of the year.

-

Special Report

Special Report‘Russians are convinced they were betrayed’

Professor Rainer Wedde of Wiesbaden Business School discusses the forces behind a decade of rising tensions between Russia and the West

-

Special Report

UK In-house Management: Is it better in-house?

In-house asset management can deliver cost savings, control and overall value benefits but for complex or short-term strategies external management may offer better value for money

-

Asset Class Reports

FAANGS: Tech black swan in the wings?

The US technology giants could be hit by extreme risks