As US managers avoid a tariff-led recession, there is optimism in Europe, despite subdued macroeconomic data

Entering the final quarter of the year, 2025 global economic growth appears to have held up better than many forecasters had predicted at the start of the year. This is despite all the tariff uncertainties and policy upheavals. Furthermore, despite some stretched valuations, sentiment towards the US stock market remains ebullient, thanks to strong corporate earnings.

However, the US economy is slowing, even though the inflationary effects of the tariffs have not, as yet, fed through to higher prices.

The US job market has now become the Federal Reserve’s primary focus, having shown clear signs of weakness. The slowdown is not, however, expected to evolve into a recession, with market talk of the Fed engineering one of its hallowed ‘soft-landings’, before growth then picks up gently over 2026.

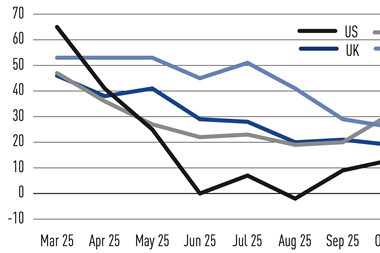

For Europe, overall economic data still paints a rather subdued state, with solid services activity counterbalancing the slack from lacklustre manufacturing data. There is optimism, however, that significantly higher defence spending in the euro area, coupled with Germany’s plans for increased infrastructure investment, should support growth across the region over the coming year.

Unsettled politics in France could yet disrupt Europe’s reasonable outlook. In the UK, the bleak choices facing chancellor Rachel Reeves for her autumn statement suggest that here too, political disruptions could shine some unwanted limelight. Sticky inflation, so often a problem for the UK economy, has tempered calls for rate cuts from the Bank of England. With subdued economic growth and unemployment potentially on the rise, the incumbent Labour Party continues to generate uncomfortably negative headlines.

When inflation started rising quickly in 2022, the gold price began accelerating. Its rise so far this year, in the absence of globally higher inflation, has been even more meteoric, as the precious metal continues to benefit from this year’s much heightened uncertainties, both macro-economic and geopolitical.

Bonds: yield curves steepen

The Fed’s pivot to focus more on the weakening labour market, and away from its inflation mandate, is a sign that rate cuts are on their way. However, the US economy remains buoyant despite declining job numbers. Stock markets are now happily looking forward to those lower policy rates and hopefully even lower tariff uncertainty.

Changing leadership in the Federal Reserve is underway, beginning with the recent appointment of a new, and very vocally dovish, Fed governor Stephen Miran, now “on leave” from his post as economic adviser to the US president. When Fed chair Jerome Powell’s term expires in February 2026, his replacement will, presumably, be another more dovish voice, certainly more so than Powell.

However, if growth does recover, and markets’ inflation pricing needs to be redressed, rates markets will also have to adjust their dot plots higher. With a more dovishly populated Fed effectively anchoring the short end, this could mean steepening curves as 5-year, 10-year rates and beyond move higher.

US and European rates have been showing a lower correlation over recent months. The European Central Bank (ECB) seems very unlikely to develop a more dovish stance, which argues for relatively flatter curves across European rates compared with the US. Though France’s continuing political disruptions have certainly damaged relative OAT values, periphery spreads have, on the other hand, generally narrowed over this year.

For Bunds, some observers suggest that the amount of term premia priced in may be excessive. The Bund curve, which was flat or inverted last autumn, steepened rapidly in spring 2025 along with other bond markets, led by the US and Japan. But German yields were then propelled higher by the prospect of large fiscal easing in Germany.

With the US now in another government shutdown, highlighting the tensions and rancour amongst the country’s political parties, safe havens become more desirable in these tense times, and the steady Bund market could stand to benefit from even a small diversification out of US Treasuries from increasingly anxious US investors.

Currencies: further US dollar weakness on the horizon

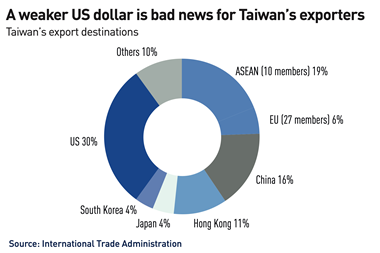

Although the steepness in the dollar’s downward trajectory eased off somewhat over the summer, there is a reasonably strongly held consensus view that further dollar weakness is still to come. This view is based on the combination of lesser US exceptionalism, as Europe’s fiscal pivot remains in place, with less favourable interest rate differentials, as the Fed has also begun cutting rates.

There is, however, less agreement around whether a more structural currency move is also underway. This is unlikely the prospect of ‘de-dollarisation’ and the dollar losing its hegemonic role as ‘the world’s currency of choice’.

The prevailing forces presently weakening the US currency, such as lower interest rate support for the currency, and more Fed cuts predicted later this year, as well as the talk of foreign investors choosing to hedge more of their US exposure, are well-flagged. Rather less tangible are the political changes that may be influencing Fed leadership and, potentially, its true independence from any political influences.

However, these cyclical downward forces are not necessarily connected to, or necessary harbingers of, the processes of de-dollarisation. The US dollar’s position as the world’s dominant currency remains irrefutable. The dollar’s “TINA” status – there is no alternative – is hard to dismiss, and changes are very likely to be gradual. Think of the USD’s use in cross-border trade, in the enormous and expanding FX market, and in SWIFT payments.

Emerging market currencies have been enjoying the environment, with the prospect of the Fed easing – but without the fear of a US recession – boosting emerging market assets and currencies. The AI narrative has moved into the emerging market domain, driving tech-oriented emerging market stocks, which have in turn supported related currencies.