All IPE articles in May 2020 (Magazine)

View all stories from this issue.

-

Features

FeaturesLong Term Matters: Learning from COVID-19

As the tide of the Second World War was turning in favour of the Allies, there was a ferment of discussion – initially bottom up – about how to build a better world when the war was over. While loved ones were fighting overseas and people at home were struggling with rationing and movement restrictions, some made the time to think about the future. The Bretton Woods Agreement, establishing fixed exchange rates, happened ten months before the war ended in Europe.

-

Analysis

AnalysisPerspective: COVID-19: Funds seek solace in the long term

COVID-19 is forcing European pension funds to put on a brave face as asset portfolios and funding ratios plummet, and regulators soften their stances.

-

Analysis

AnalysisPerspective: Inspired actuaries form COVID-19 rapid response group

At the onset of Europe becoming the epicentre of the coronavirus crisis, there were individuals in one profession that were keen to act as quickly as possible in response to what they saw “could well be humanity’s burning platform for change”.

-

Analysis

AnalysisPerspective: EIOPA’s COVID-19 address reassures

A coronavirus crisis statement from EIOPA addressed to national supervisors drew positive words from lobby groups PensionsEurope and the European Association of Paritarian Institutions (AEIP).

-

Features

FeaturesBriefing: COVID-19 crisis shines light on private equity tech

It was five years ago that Partners Group’s disaster-recovery team began preparing for a crisis like the one that would shut down all but four of its 20 offices by the end of March.

-

-

-

Features

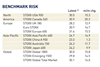

FeaturesIPE Quest Expectations Indicator May 2020

Using last month’s model of the statistics on daily new cases as an early indicator and daily case mortality as evidence of policy change, the 21 April situation looks like:

-

Special Report

Special ReportImpact principles: Held to account

How will the IFC’s impact investment principles help investors seeking transparency and clarity about their investments?

-

Analysis

AnalysisPensions accounting: A matter of survival

If there is one thing DB scheme sponsors and trustees can be sure of this year, the COVID-19 pandemic is going to affect not only their ability to fund schemes but also how they account for them

-

Features

Briefing: A close look at active credit

Research suggests credit mutual funds and hedge funds are not delivering outperformance

-

Opinion Pieces

Opinion PiecesGuard against mission creep

As the impact of the coronavirus continues to make itself felt, largely out of sight in hospitals and care homes, the parallel with today’s social, market and economic situation feels unusually apt

-

Opinion Pieces

Factor investing: Viewpoint: The case against factor investing

Factor products are not necessarily a panacea for equity market outpeformance

-

Features

FeaturesAhead of the curve: Can the system win in EMs?

Systematic investment models have been commonplace in equity markets. Can they generate returns in emerging market debt?

-

Special Report

Special ReportZurich Insurance Group: Zurich’s ambition to measure and manage

With ambitious impact targets, Zurich Insurance Group needed to develop a robust framework to measure progress

-

Special Report

Special ReportUpright Project: Applying tech to impact

Nordic institutions are backing an AI approach to assessing individual businesses and their impacts

-

Special Report

Special ReportImpact investing: Build back better

It is a common observation – supported by the likes of the World Bank and the United Nations – that incorporating resilience into communities after a natural disaster helps prepare them for future catastrophes. This is known in the jargon as ‘building back better’.

-

Features

FeaturesBriefing: Long-term investing: it’s up to the pension board

A practical framework for pension fund trustees looking to implement long-term investment approaches

-

Special Report

Special ReportBribery and corruption: Sustainability’s nemesis

SDG 16.5, covering bribery and corruption, is central to other SDGs but hard to tackle in practice

-

Opinion Pieces

Opinion PiecesNot business as usual

Basing investment decisions on short-term events can have long-term consequences, so it is vital trustees seek guidance