All IPE articles in November 2019 (Magazine) – Page 2

-

Opinion Pieces

Opinion PiecesBond bubble threatens emerging markets

Although the prospect of a trade war is the tail risk that has most worried fund managers since mid-2018, other potential perils look more threatening

-

Features

FeaturesBriefing: There is still room for growth

Equity investors putting faith in growth stocks – stocks that are priced expensively relative to fundamentals because they are expected to grow fast – received a shock in early September when they sold off sharply.

-

Special Report

Special ReportThe buy-side: Greater focus on quality

There is growing demand for research that genuinely adds value

-

Asset Class Reports

Asset Class ReportsSpeciality Credit: Where the cash flows

Niche credit strategies such as shipping and aviation are gaining attention in the persistent low-yield environment

-

Asset Class Reports

Asset Class ReportsEmerging market debt – ESG: Taking centre stage

ESG considerations are increasingly embodied in investment in emerging market debt

-

Features

FeaturesFixed income, rates, currencies: Clouded by uncertainty

It was predictable that risk markets should have reacted positively to the news of an agreement in principle in the US-China trade negotiations. Although assuredly better than a seemingly relentless stream of bad will between the protagonists, the provisional agreement is in no way a solution to the conflict. Another round of trade talks could be necessary just to reach a tentative accord. Investors would be wise to temper enthusiasm to extrapolate the ‘good news’ too far.

-

Opinion Pieces

Opinion PiecesViewpoint: Investors commit to a net-zero future

The global climate emergency means investors must set tough decarbonisation targets. A new UN-convened investor alliance is doing just that

-

Special Report

ESG: The long quest for comparable data

A growing band of institutional investors and other financial actors is seeking better and more comparable inputs to financials statements in areas like carbon emissions

-

Features

FeaturesMiFID II in the US: Complexity cost

The impact of MiFID II in the US is complicated and convoluted

-

Special Report

Special ReportInvestment Process: A recipe for confusion

The shift to ESG has inadvertently led to divergence of opinion over the best metrics to use

-

Features

FeaturesTributes pour in for ‘founding father’ of investment consulting

Tim Gardener, the man credited with making visionary contributions to the UK investment consulting industry, died in October.

-

Special Report

Research: Europe has turned a corner

Asset managers must cater to the trend to deeper ESG investing to remain competitive Key points ESG investing in Europe has developed over more than three decades There are four broad categories of ESG investment – exclusion, integration, stewardship and impact Integration is the most widespread approach ...

-

Country Report

Country ReportGulbenkian Foundation: Green credentials

The Calouste Gulbenkian Foundation is realigning its portfolio to meet green requirements

-

Interviews

InterviewsOn the record: Private credit

As the valuations of traditional credit assets look stretched, we asked two Danish institutions how they invest in alternative credit markets

-

Asset Class Reports

Asset Class ReportsCredit: In the eye of the storm

What are the prospects for the credit markets as central bank turn dovish and economic activity slows down?

-

Special Report

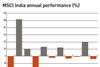

Special ReportIndia: Still early days

The growing adoption and importance of ESG criteria among Indian firms could have implications for companies such as rice producers

-

Features

FeaturesPerspective: Fear the walking dead

Zombie firms – those dependent on the easy availability of cheap credit – threaten to suck the life out of otherwise viable companies

-

Opinion Pieces

Opinion PiecesSystemic risk debate intensifies

The financial system is facing its greatest challenge since the 2018 financial crisis

-

Asset Class Reports

Asset Class ReportsEmerging market debt – Global view: A mixed picture

Although emerging markets are in aggregate enjoying structural improvements, there are stark differences between regions

-

- Previous Page

- Page1

- Page2

- Page3

- Next Page