Latest from IPE Magazine – Page 229

-

Features

Appeasing the gatekeeper

Last year I attended a drinks reception organised by a UK consultancy. The event was arranged specifically to allow the firm’s staff to meet with the asset management community. The theme running through the opening remarks was simple: “We have no current or future plans to offer fiduciary management, therefore we will never compete with you.”

-

Country Report

Domestic Accounting: Discounting the future

The new discount rate to be applied to pension liabilities under German accounting standards simply postpones a serious problem

-

Special Report

Talking heads

IPE asked pension consultants across Europe for their views on how existing and new regulation is affecting their clients and how they are advising them to react

-

Asset Class Reports

Implementation: Points of entry

Investors have several ways of accessing European equities including passive, active and smart-beta strategies

-

Asset Class Reports

Heading for the Brexit?

The possibility of the UK voting to leave the EU is causing considerable uncertainty among asset managers

-

Special Report

Portfolio Construction: Calculated risks

Factor investing promises to outperform both passive and active management. Carlo Svaluto Moreolo discusses the issue of implementation

-

Country Report

Domestic Accounting: A half-hearted compromise

Thomas Hagemann reviews changes to the discount rate methodology applied by corporates to calculate pension liabilities

-

Asset Class Reports

Do not bank on another crisis

Despite problems in Europe and globally, opinions are split on the likelihood of another banking crisis

-

Special Report

Factor investing: Pension funds in two minds

Factor investing might be a relatively new approach but some pension funds are already employing it with success. Others are looking on with interest

-

Country Report

Investment Tax Reform: A simplification gone wrong

The investment industry has successfully lobbied against many new requirements in the investment tax reform law. Barbara Ottawa says it might not be so fortunate in the future

-

Asset Class Reports

European pharma under threat

Pharmaceuticals have long been the foundation of Europe’s industrial base. Now the sector must fight back against the threat of US biotech companies

-

Special Report

Railways Pension Scheme: World-class transformation

Gail Moss investigates how the UK Railways Pension Scheme transformed its investment strategies to cope with the low-return environment that has followed the global financial crisis

-

Asset Class Reports

Sensitivity of selected European equity funds to macro factors

The data shows the sensitivity of European equity funds to changes in a selection of macroeconomic factors: European default spreads, European term spreads, European interest rates and European inflation.

-

Special Report

Pioneers: Better be smart

Lynn Strongin Dodds finds that as the strategy becomes more popular, pioneers in the alternative-indexation field are warning investors to avoid being just performance chasers

-

Special Report

Origins of the smart beta species

Andrew Clare, Stephen Thomas and Nick Motson trace the roots of smart beta that began as a test of the Efficient Market Hypothesis in universities in the 1970s

-

Special Report

Index Providers: Benchmark bonanza

The rapid growth and popularity of new of multi-factor smart beta strategies are fuelling the creation of a plethora of indices

-

Features

FeaturesBanks and LDI

The rise of liability-driven investments (LDI), pairing cashflow-matching assets with forecast liability streams, has developed in tandem with a broad, overall maturing of the liabilities of the European occupational pension sector

-

Features

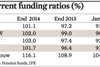

FeaturesDutch Funding: Facing a painful squeeze

Dutch pension funds’ nose-diving coverage ratios underline just how futile various measure have been in improving funding and minimise rights cuts

-

Features

FeaturesUK Local Government Pensions: Choose your partner

After years of debate, concrete details regarding the future of the UK local authority pensions sector are emerging

-

Features

PLSA Investment Conference: Industry embraces FCA asset management review

The question of whether the asset management market is working for pension funds and other investors, as the UK Financial Conduct Authority (FCA) is asking, was a theme at the UK pension fund association’s conference in Edinburgh.