IPE's EU Coverage – Page 27

-

Special Report

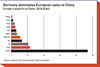

Special ReportChina: Befriending the dragon

Italy’s decision to join China’s Belt and Road Initiative has prompted criticism from the EU and the US

-

Features

FeaturesDC’s collective voice could be decisive

Australian pension funds could soon become the biggest shareholders in their country’s equity market (see page 5), with researchers at Rainmaker Information forecasting their combined domestic stock holdings to hit 60% by 2033.

-

-

Features

FeaturesInterview: Sharon Bowles – A forensic assessment

The former chair of the European Parliament’s Economic Affairs Committee talks to Stephen Bouvier

-

Interviews

InterviewsOn the Record: Tough times at home

We asked two pension funds to share their views about investing in Europe at this crucial juncture for its economy

-

News

Irish pension funds voice ‘frustration’ at regulatory delays

Government ‘cannot take its foot off the gas’ over the summer if it is to succeed with ambitious reforms, IAPF says

-

News

Joseph Mariathasan: Should the West blame China for the trade war?

For China, catching up with the US and Europe means climbing the intellectual property ladder – and it is well positioned to do that

-

News

NewsFive banks hit with €1bn in fines after ‘banana split’ FX cartel uncovered

Barclays, the Royal Bank of Scotland, Citigroup, JPMorgan, UBS and MUFG Bank fined by European Commission over ‘Banana Split’ and ‘Essex Express’ cartels

-

Analysis

AnalysisAnalysis: Experts warn of bank stress test impact on covered bonds

ECB’s banking sector stress tests have caused concern among covered bond analysts over the potential impact on the attractiveness of the asset class

-

News

ESG roundup: PE manager claims record with $700m impact fund

LeapFrog attracts European pension funds, asset managers and insurers for impact fund; Finnish pension insurer Varma backs human rights campaign

-

News

ESMA: ‘We need to be more nuanced about sustainability’

Sustainability is about more than a binary choice between ‘brown’ and ‘green’ assets, says Europe’s top financial regulator

-

News

NewsGovernments urged to provide long-term decarbonisation clarity

Investors and corporates say policy makers need to set ‘direction of travel’ to enable them to act

-

News

EIOPA to prioritise IORP II ‘supervisory convergence’

2019 priorities to include ‘promotion of supervisory convergence in the European pensions sector regarding the implementation of IORP II’

-

News

Regulators urge pension funds to use new benchmarks ahead of Libor end

Euribor, Libor and Eonia to be phased out following new European regulation

-

News

Commission launches infringement action against 17 states over IORP II

Proceedings launched for “non-communication” of transposition measures after January deadline

-

News

NewsMoody’s: PEPP rollout to boost insurers and ESG-focused managers

New cross-border product will open up markets for managers and pension providers, rating agency says

-

News

NewsAccounting roundup: Guidance issued on pension equality costs

Plus: Hybrid pension plan accounting; Politicians call for break up of ‘big four’; FRC publishes draft plan and budget

-

News

Moody’s: No-deal Brexit ‘manageable’ for EU asset managers

Asset managers’ and regulators’ preparations would minimise impact

-

News

NewsEuropean Parliament gives green light to PEPP framework

Portable personal pension products to have cost cap and multiple investment options

-

News

EIOPA launches pension fund stress tests

European regulator increases reporting period for pension funds and national authorities