Asset Allocation – Page 65

-

News

Finnish roundup: Elo hails new business gains, VER laments 3.4% loss

State pension buffer fund VER says 2018 provided scant opportunities for hedging

-

News

NewsNorway’s sovereign fund records €50bn investment loss for 2018

Europe’s biggest fund has recouped some of its 6.1% loss in early 2019 as markets bounced back

-

News

Brexit: Nordic pension funds reveal their approaches to UK assets

SPK, Veritas and Apteekkien Eläkekassa explain their approaches to political risk in the EU

-

News

News‘Brutal’ stock markets hurt FRR’s return in 2018

French reserve fund posts 5.2% investment loss after return-seeking assets fall 8%

-

News

NewsAP3 records positive 2018 return after gains on unlisted assets, FX

Swedish buffer fund posts 0.6% return and adds SEK6.8bn to state pension system

-

News

NewsFinland’s top providers cushion 2018 losses with real estate, private equity

Ilmarinen’s merger and new client activity helped cement its position as the country’s biggest provider

-

News

RBS incurs £102m cost of equalising pension payments

UK’s third-biggest pension scheme reveals GMP equalisation costs and slashes equity exposure

-

News

Chart of the Week: DC overtakes DB in top seven pension markets

€35.6trn invested in 22 markets, Willis Towers Watson reports, with DC making headway in the UK, Canada and Japan

-

News

NewsProperty, fixed income boosts KLP’s 2018 result

Norwegian municipal pensions giant “well prepared” for new competition

-

News

NewsSweden’s AMF reports 1.3% gain as property shines

CEO says investment profit testifies to lower market correlation of portfolio assets

-

News

Denmark roundup: Providers praise hedges for stemming 2018 losses

PFA, Velliv and AP Pension provided best protection to customers from equity market falls

-

News

PFA ends 2018 with 3.3% loss after market slump

Danish pension fund adds unlisted assets to counter volatility

-

News

Norway’s sovereign fund pulls plug on ESG managers to cut costs

GPFG’s manager grapples with new issues in low-carbon transition

-

News

NEST looks to add global corporate bonds to growing portfolio

Tender launched for DC master trust’s first allocation to global investment grade bonds

-

News

ATP’s geared portfolio dives 9% in last quarter of 2018

Leverage reaches 334% by year end for Danish fund’s investment segment

-

News

Interview: Mats Langensjö weighs options for Sweden’s giant AP7

Default fund in Premium Pension System under scrutiny after record growth

-

News

Asset owners ‘should push for strategy, fee innovation’ at hedge funds

Hedge funds too focused on tangential issues, says Willis Towers Watson

-

News

Diversification appetite driving greater small cap demand: bfinance

Investment consultant group relays stronger interest among its institutional investor clients

-

News

Chart of the Week: 2018’s most popular asset classes

Public sector funds in the UK and US awarded almost 1,000 private equity mandates last year

-

Asset Class Reports

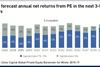

Asset Class ReportsAsset allocation: Opportunities abound despite volatility

The many uncertainties on the global stage might not be bad news for everyone