Latest Special Reports – Page 39

-

Special Report

Factor investing (smart/enhanced beta) strategies/products 2019

Factor investing (smart/enhanced beta) strategies/products table

-

Special Report

Special ReportTricky, but worthwhile

Help is at hand for institutional investors interested in pursuing, or deepening their efforts in impact investing

-

Special Report

Special ReportManager selection: Facing a difficult test

The resilience of private debt funds will be tested in the forthcoming downturn

-

Special Report

Special ReportMulti-asset strategies: New tools

Quantitative easing has distorted the fixed-income markets, resulting in an increased need to manage liquidity within credit strategies

-

Special Report

Special ReportPublic Markets: Hard to pin down

A mishmash of blurred definitions and terminology borrowed from ESG and sustainability is marring the progress of impact investing in public markets

-

Special Report

Trade Finance: Funding tradewinds

Trade finance can offer an illiquid position in a volatile market, but its idiosyncratic nature can dissuade investors

-

Special Report

GIIN: Setting the bar

The CEO of the Global Impact Investing Network, an organisation dedicated to promoting impact investing, talks about the need for ‘baseline expectations’

-

Special Report

Special ReportAsset Allocation: Private credit is here to stay

Despite warnings of its imminent demise the asset class is here to stay

-

Special Report

Special ReportAP1 - A circular focus

Swedish buffer fund AP1 highlights resource efficiency as key to a sustainable investment strategy

-

Special Report

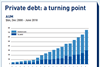

Special ReportMarket Trends: Critical point

Private market lending now faces an important turning point

-

Special Report

Actis: Thinking deep about measurement

Private markets investor Actis is taking impact measurement seriously

-

Special Report

Legal Framework: The lay of the law

A new project aims to find answers to some fundamental legal questions about investing, people and planet

-

Special Report

Special ReportAlignment: mind the gap

What role might market participants play to plug the SDG gap?

-

Special Report

Fiduciary Duty: Making the right impact

Impact funds range from those that seek to generate attractive returns while pursuing social objectives to those that focus solely on the social aims

-

Special Report

Asset Allocation: The future looks synthetic

A decade ago, synthetic ETFs were the pariahs of the asset management industry. Now, though, the tides are turning – with some sectors experiencing a revival in synthetic flows

-

Special Report

Social Impact Investing: Need for clear definitions

Measuring genuine social impact investing means disentangling it from conventional investing with elements of ESG

-

Special Report

Special ReportSocial Impact Finance: Bonds to help Asia’s ‘missing middle’ women

An initiative to raise money to provide low-cost finance for rural female entrepreneurs

-

Special Report

Special ReportThought Leadership: Investment in the age of geo-economics

Brexit, Trump, unprecedented Sino-American trade tensions: country risk and political considerations have moved to the fore and pension investors and asset managers alike have had to revise their investment strategies

-

Special Report

Special ReportAI and Manager Selection: Will your future consultant be a machine?

The world’s largest pension fund is exploring the use of AI to help it select asset managers and assets in which to invest

-

Special Report

Special ReportFactor investing: The paradox of low volatility

Despite scepticism by some investors, low-volatility investing does appear to work, especially during market downturns