Latest Special Reports – Page 31

-

Special Report

Real estate, infrastructure, commodities, tactical asset allocation 2020

Real estate, infrastructure, commodities, tactical asset allocation

-

Special Report

Factor investing (smart/enhanced beta) strategies/products 2020

Factor investing (smart/enhanced beta) strategies/products table

-

Special Report

Special ReportFactor investing: Crisis factor

What are the prospects for factor-based portfolios after the recent market crash?

-

Special Report

Special ReportImpact investing: Build back better

It is a common observation – supported by the likes of the World Bank and the United Nations – that incorporating resilience into communities after a natural disaster helps prepare them for future catastrophes. This is known in the jargon as ‘building back better’.

-

Special Report

Special ReportFactor investing: Keeping a distance from single factors

The fluctuations of single factor returns have bolstered multi-factor strategies

-

Special Report

Special ReportImpact integrity in private equity

Robust and credible reporting standards will be essential to avoid any suspicion of impact washing

-

Special Report

Special ReportInvestors: Making money matter

How are asset owners looking to scale up impact as their portfolios and experience grow?

-

Special Report

Factor investing: Will corona be a watershed moment for credit factor investing?

Credit factor investing is in its early stages, but models and data are improving

-

Special Report

Special ReportPhenix Capital: Measuring the market

A new report by Amsterdam-based Phenix Capital runs the rule over the growing marketplace for impact funds

-

Special Report

Special ReportImpact Investing Institute: The way forward

Sarah Gordon, CEO of the Impact Investing Institute, is building awareness of SDG-related opportunities

-

Special Report

Special ReportUpright Project: Applying tech to impact

Nordic institutions are backing an AI approach to assessing individual businesses and their impacts

-

Special Report

Special ReportZurich Insurance Group: Zurich’s ambition to measure and manage

With ambitious impact targets, Zurich Insurance Group needed to develop a robust framework to measure progress

-

Special Report

Special ReportImpact principles: Held to account

How will the IFC’s impact investment principles help investors seeking transparency and clarity about their investments?

-

Special Report

Special ReportBribery and corruption: Sustainability’s nemesis

SDG 16.5, covering bribery and corruption, is central to other SDGs but hard to tackle in practice

-

Special Report

Special ReportPensions tech: Fine-tuning the options for multinationals

ADA fintech software enables multinational pension schemes to weigh up a vast range of data and information

-

Special Report

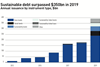

Special ReportPrivate and green: Non-listed sustainable debt

The market for non-listed debt with green or sustainability features is growing fast

-

Special Report

Special ReportDashboard tech: How AI can transform pensions

Dashboard technology like Moneyhub has the potential to prompt consolidation in UK DC pensions

-

Special Report

Special ReportTransition bonds: Questions of transition

The market for sustainable investments is growing exponentially