All Special Report articles – Page 31

-

Special Report

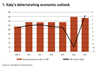

Special ReportEuro-zone: A crisis like no other

The COVID-19 pandemic, alongside the associated economic shutdown, has had an unprecedented effect on EU member states

-

Special Report

Special ReportJonathan Doolan: Preparation and tech investment has paid off

IPE asked 10 leading commentators to tell us what challenges they believe the coronavirus crisis raises for the institutional asset management sector and its client base

-

-

Special Report

Special ReportSarah Williamson: Prioritising a problem-solving mindset will pay off

IPE asked 10 leading commentators to tell us what challenges they believe the coronavirus crisis raises for the institutional asset management sector and its client base

-

Special Report

Special ReportImpact principles: Held to account

How will the IFC’s impact investment principles help investors seeking transparency and clarity about their investments?

-

Special Report

Special ReportZurich Insurance Group: Zurich’s ambition to measure and manage

With ambitious impact targets, Zurich Insurance Group needed to develop a robust framework to measure progress

-

Special Report

Special ReportUpright Project: Applying tech to impact

Nordic institutions are backing an AI approach to assessing individual businesses and their impacts

-

Special Report

Special ReportImpact investing: Build back better

It is a common observation – supported by the likes of the World Bank and the United Nations – that incorporating resilience into communities after a natural disaster helps prepare them for future catastrophes. This is known in the jargon as ‘building back better’.

-

Special Report

Special ReportBribery and corruption: Sustainability’s nemesis

SDG 16.5, covering bribery and corruption, is central to other SDGs but hard to tackle in practice

-

Special Report

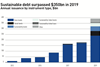

Special ReportPhenix Capital: Measuring the market

A new report by Amsterdam-based Phenix Capital runs the rule over the growing marketplace for impact funds

-

Special Report

Factor investing: Will corona be a watershed moment for credit factor investing?

Credit factor investing is in its early stages, but models and data are improving

-

Special Report

Special ReportFactor investing: Crisis factor

What are the prospects for factor-based portfolios after the recent market crash?

-

Special Report

Special ReportFactor investing: Keeping a distance from single factors

The fluctuations of single factor returns have bolstered multi-factor strategies

-

Special Report

Special ReportImpact integrity in private equity

Robust and credible reporting standards will be essential to avoid any suspicion of impact washing

-

Special Report

Special ReportImpact Investing Institute: The way forward

Sarah Gordon, CEO of the Impact Investing Institute, is building awareness of SDG-related opportunities

-

Special Report

Special ReportInvestors: Making money matter

How are asset owners looking to scale up impact as their portfolios and experience grow?

-

Special Report

Special ReportDashboard tech: How AI can transform pensions

Dashboard technology like Moneyhub has the potential to prompt consolidation in UK DC pensions

-

Special Report

Special ReportStrategically Speaking: HSBC Global Asset Management

As the financial markets enter uncharted territory, HSBC GAM could be well placed to take advantage of the dislocations in Asian and emerging markets. Its aim, though, is to offer investors the full spectrum of fixed-income solutions, says Xavier Baraton, global CIO for fixed-income private debt and alternatives.

-

Special Report

Special ReportGreen bond issuance: Denmark's split offering

The Danish government is keen to employ tradeable green certificates, which are designed to broaden the appeal of environmental debt, in its initial green bond issuance

-

Special Report

Special ReportTransition bonds: Questions of transition

The market for sustainable investments is growing exponentially